Introducing Economics’ New Standard Model

Part I: Context

Chronic economic problems continue to plague every facet of human life. Part I of this book briefly introduces the basis of Bernard Lonergan’s solution, originally discovered in the 1930’s,1Part of what moved him to think about economics was the Great Depression. Pierrot Lambert and Philip McShane, Bernard Lonergan, His Life and Leading Ideas (Vancouver: Axial Publishing, 2010), 40-42. See also the second last paragraph of Sec. 3.3. and subsequently published by the University of Toronto Press in 1998.2CWL21. Lonergan’s breakthrough has yet to be adopted by professional economists. However, by the end of Part I, it should be evident that his approach is the scientific basis for a new standard model in economics.

First, though, it would help to say something about the current mainstream approach that is taken for granted by professional economists. It is a complex synthesis of views and techniques that only gradually emerged historically. And, irrespective of his own views, Colander’s 2004 observation still holds: the face of mainstream economics continues to change3David Colander, Richard Holt, and Barkley Rosser, “The Changing Face of Mainstream Economics,” Review of Political Economy 16, no. 4 (October 1, 2004): 485–99, https://doi.org/10.1080/0953825042000256702.. So does debate regarding the setting of priorities for ongoing changes in the field4Tim Thornton, “The Changing Face Of Mainstream Economics?,” Journal of Australian Political Economy 75 (Winter 2015): 11–25..

At its core, the history of economic thought and practice is undermined by methodological confusion. First, there is the widely acknowledged problem of hypothetical models supporting current economic theories, whether social, political, mathematical or otherwise, that, at best, are only loosely based on concrete economic circumstances5For an elementary instance, a basic feature of contemporary economics is the circular flow model. “Imagine an economy that produces a single good, bread, from a single input, labor. Figure 2-1 [in Mankiw’s book] illustrates all the economic transactions that occur between households and firms in this economy” (Gregory N. Mankiw, Macroeconomics, 8th ed. (New York, New York, Worth Publishers, 2012), 19. A basic problem, however, is that the circular flow economy that one is asked to imagine does not represent actual economic process. This will become evident by the end of Ch. 3, below. Nevertheless, the circular flow model is a premise for defining and measuring GDP/GNP and related quantities used by economists and nations of the world. See Sec., 4.1, below, “Economic Malpractice.”, and second, views and debates about mainstream models are at a still further remove. For not only do they regard models that are not verifiable in instances in economic process (homes, businesses, production, provision, and finance), but the debates themselves center on nominal logic, discussions in general terms, and hypothetical models regarding the hypothetical economic models. And, so far, attempts to reform economics (heterodox, ecological, and so on) follow the same methodological tradition and consequently have not escaped its fundamental limitations. Suffice it to say, then, global progress in economics will require a new foundation for ongoing collaboration in the future academy6See Ch. 5, Pt. I and Ch. 10, Pt. II..

For present purposes, this confusion can be illustrated with an example from an Op-Ed in the Financial Times on “how to fix university economics courses.” Wendy Carlin (University College London) and Sam Bowles (Professor Emeritus at the University of Massachusetts Amherst) observe that

an introductory economics course can be pluralistic in two ways. It can juxtapose schools of economic thought or disciplines in a kind of paradigm tournament. Or, they went on, it can integrate the insights of the different schools of thought and disciplines in a common narrative and related analytical models. Both approaches can be valuable; but CORE takes the second approach because we have concluded that it better equips students to reason analytically and empirically, and come to their own conclusions about problems such as inequality, the future of work and climate change. The FT op ed illustrates CORE’s pluralism-by-integration approach with our model of the labour market and the firm.7Wendy Carlin and Sam Bowles, “How to fix university economics courses,” Financial Times, Jan. 17, 2019.

Notice that in the two ways described, one either juxtaposes or integrates “schools of thought” with “models.” Each way effectively blocks the possibility of escaping already established paradigms and methods. What the authors construct, then, is yet another model, “our model of the labour market and the firm.”

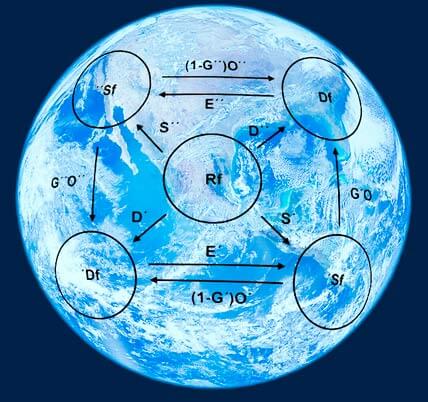

Economics Actually introduces an approach that overcomes this methodological confusion by investigating concrete circumstances. How does any particular business actually operate? Where does the money go? How do different goods and services contribute to production and provision of goods and services available to any particular village, town, city or region? It therefore works on the basis of facts and data.8See John Benton and Terrance Quinn, Journeyism. A Handbook for Future Academics, 1st ed. (Toronto: Island House Press, 2022), Preface, 17–35, 37–67, 103–120. In other words, it observes and analyzes measurable quantities such as actual rates of production, provision, and monetary flow, to uncover the mechanical structure of economic process essential to understanding any economic event, aggregate of economic events and, for that matter, any economy. The structure involves two types of production and provision and five monetary functions. The second type of production and provision is for the first, and the first type of production and provision is for our day-to-day living. “Let us assume as known what is meant by the term ‘standard of living.’ Let the term ‘emergent standard of living’ mean the aggregate of rates9The aggregate of rates here and subsequently means all actual rates in the economy. at which goods and services pass from the productive process into the standard of living.”10CWL21, 238. Lonergan’s subsequent identification of the term ‘standard of living’ notwithstanding, we defer its discussion to Ch. 10. We do, however, employ the term ‘emergent standard of living’ throughout, because it refers to measurable rates.

The insights in this book, as distinguished from Lonergan’s original work11Bernard Lonergan, For a New Political Economy, ed. Philip J. McShane, 1st ed., vol. 21, Collected Works of Bernard Lonergan (Toronto: University of Toronto Press, 1998)., fulfill a prior need. They are also a bridge and complementary to Philip McShane’s introductory works in economics.12McShane, Economics for Everyone, 3rd ed., Philip McShane, Fusion 2, A Grade 12 Introductory Class in Economics, https://philipmcshane.org/wp-content/uploads/2023/01/Fusion-2.pdf. The chapters in Part I below, then, gradually introduce the general structure of modern economies and move toward a practical approach to economic wellbeing. The chapters in Part II enlarge on these topics.

Chapter 1 focuses on the emergence of the productive process. Notwithstanding the prehistorical setting, the structure revealed is present in all economies.

Chapter 2 goes further and describes two kinds of work and two kinds of goods and services in any economy.

Chapter 3 provides a brief glimpse of correct heuristics for two kinds of supply and demand and financial structures in modern exchange economies.

Chapter 4 looks into aspects of contemporary models and financial structures that are inimical to economies, humanity and ecosystems.

Chapter 5 touches on the larger context which includes culture and economics, recovery and the possibility of (ongoing) progress. A short section at the end of a brief introduction cannot go into detail. But it does describe something of the context and provide references for further reading.

References