Economics

Economics

The Future of Economics

Economics Actually (Second Edition) introduces a new basis for economic science. Unlike mainstream economics, it begins with facts and data and thus reveals key monetary functions and relations by which to understand any economy and any economic event. The structure is operative in firms of all sizes, from small businesses to global corporations and stock markets. Irrespective of the many areas of inquiry in contemporary economics, Economics Actually focuses on the mechanical structure of economic process.

The Future of Economics

Economics Actually (Second Edition) introduces a new basis for economic science. Unlike mainstream economics, it begins with facts and data and thus reveals key monetary functions and relations by which to understand any economy and any economic event. The structure is operative in firms of all sizes, from small businesses to global corporations and stock markets. Irrespective of the many areas of inquiry in contemporary economics, Economics Actually focuses on the mechanical structure of economic process.

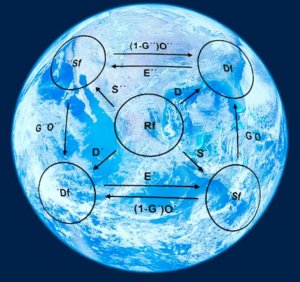

Introducing Economics’ New Standard Model

Part I uncovers the mechanical structure of economic process essential to understanding any economic event, aggregate of economic events and, for that matter, any economy. It establishes the fact that in any economy there are two main types of production and provision and five monetary functions.

Elements of Economics’ New Standard Model

Part II focuses on how actual businesses operate in the productive process. It asks: What is happening in concrete situations? Its results shed further light, with additional detail, on how the New Standard Model will overcome the cluster of errors in current mainstream practice, domestically and internationally.