Elements of Economics’ New Standard Model

Part II: Context

We all sense instinctively that something is wrong. But we struggle to put our finger on it.1David Pilling, The Growth Delusion. Wealth, Poverty and the Well-being of Nations (New York: Tim Duggan Books, 2018), 4.

— David Pilling (Africa Editor for The Financial Times, 2018)

Part I has established the fact that in any economy there are two main types of production and provision and five monetary functions (surplus and basic supply and demand, and redistributive).2See Fig. I.3.1. It has also brought to light a cluster of errors in current mainstream practice. For instance, the circular-flow model is no more explanatory of economic process than, say, the observation that water runs downhill explains water flow (let alone global water cycles). In practice, the commoditization of money, the profit motive, and the assumption that GDP and stock markets, respectively, are gauges of economic performance, have no normative bearing on the productive process. On the contrary, it is well known that contemporary stock markets operate on principles of investment that frequently “have profound adverse effects on the real economies.”3Mitchell, “Financialism,” 42. See also Sec. 4.2 of Part I.

Part of the problem is that the mainstream approach relies on speculative model building.

Economists build their “toy economies” to help explain economic variables, such as GDP, inflation, and unemployment. Economic models illustrate, often in mathematical terms, the relationships among the variables. Models are useful because they help us dispense with irrelevant details and focus on underlying connections. (In addition, for many economists, building models is fun.)

Models have two kinds of variables: endogenous variables and exogenous variables. Endogenous variables are those variables that a model tries to explain. Exogenous variables are those variables that a model takes as given. The purpose of a model is to show how the exogenous variables affect the endogenous variables. In other words, as Figure 1-4 illustrates exogenous variables come from outside the model and serve as the model’s input, whereas endogenous variables are determined within the model and are the model’s output.4Figure 1-4 in the textbook is similar to the following diagram.

“Endogenous Variables Model Exogenous Variables. How Models Work. Models are simplified theories that show the key relationships among economic variables. The exogenous variables are those that come from outside the model. The endogenous variables are those that the model explains. The model shows how changes in the exogenous variables affect the endogenous variables” (Mankiw, Macroeconomics, 8).

But how does one know in advance what the “irrelevant details” are, or which aspects of an economy are “endogenous” and which “exogenous”?

Elsewhere, Mankiw reveals further shortcomings in the approach:

Let’s start with the problem.

There is no simple way to gauge an economy’s health. But if you had to choose just one statistic, it would be gross domestic product. Real G.D.P. measures the total income produced within an economy, adjusted for the overall level of prices.

…

So there they are. One sickness, five diagnoses. Unfortunately, I have no idea which one is right. The truth may well involve a bit of each.5N. Gregory Mankiw, “One Economic Sickness, Five Diagnoses,” The New York Times, The UpShot, June 17, 2016, https://www.nytimes.com/2016/06/19/upshot/one-economic-sickness-five-diagnoses.

Mankiw also observes that there are

three statistics that economists and policymakers use most often. Gross domestic product, or GDP, tells us the nation’s total income and the total expenditure on its output of goods and services. The consumer price index, or CPI, measures the level of prices. The unemployment rate tells us the fraction of workers who are unemployed.6Mankiw, Macroeconomics, 17–18.

Numerical data for GDP, CPI and employment rates are readily available. But what do they mean? To review, GDP merely represents a total volume in a time period. The CPI indices are average price changes for consumers as defined in mainstream economics. By definition, these quantities are remote from any particular household or firm. Moreover, they do not reflect the fact that there are two flows. And neither GDP nor CPI is explanatory or indicative of any particular economic event.

What, then, is happening in concrete situations? Part II focuses on how actual businesses operate in the productive process.

Chapter 1 draws attention to its structure by observing the operations of a small student-run painting business called QC Painting managed by Quinn and Connor7Connor is a pseudonym. over three summers (1979-1981) in Toronto, Canada.

Chapter 2 provides numerical examples to illustrate monetary functions.

Chapter 3 develops some key features of a modern exchange economy.

Chapter 4 analyzes gross domestic product and similarly defined metrics in greater detail, as well as the problem of economic growth.

Chapter 5 briefly considers contemporary growth models that, among other things, attempt to define economic growth in terms that have little to do with actual process.

Chapter 6 points to the fact that there are certain equilibria8These are not mathematical equilibria as defined in the tradition established by Walras. in the two-flow structure that are verifiable in economies from primitive to modern.

Chapter 7 explores mechanisms by which an economy moves from one two-flow equilibrium to another.

Chapter 8 explores strategies for moving an economy between equilibria.

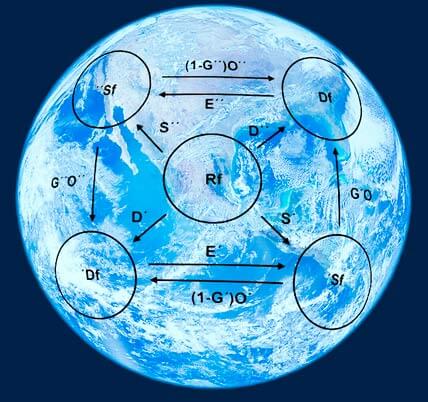

Chapters 1–8 assume a “closed economy.” Since modern economies trade internationally, Chapter 9 draws attention to the functional structure of international trade.

Chapter 10 briefly describes Bernard Lonergan’s 1965 discovery called “functional specialization.”9Bernard Lonergan, “Functional Specialties in Theology,” Gregorianum, 50 (1969): 485–505. It points to ways in which, through global collaboration, the academy will be able to move toward guiding economics to a future stage in history identified as the positive Anthropocene Age.10James Duffy, Philip McShane, Robert Henman and Terrance Quinn, Seeding the Positive Anthropocene (Vancouver: Axial Publishing, 2022).

References